>

Insights>

Market Activity>

July Trading Update. Strategies, Standouts, and Serious Results 🚀 The TPP strategy of the month.

Market Activity

July’s Trading Results Are In, And They’re Big

August 11, 2025

Related Links

July was another month where TPP portfolios didn’t just keep pace with the markets, they outperformed in style.

While news headlines were full of central bank decisions, inflation forecasts, and the usual political noise, our trading desk was busy locking in gains for our clients. This is what separates TPP from the “buy-and-hope” approach of traditional wealth managers.

Global equity markets kept grinding higher, with the MSCI World Index up +1.23% for the month.

Central banks largely stayed on hold in July:

The macro picture was far from smooth: persistent inflation in the UK, patchy growth in Europe, and slowing industrial output in Germany, but also pockets of real strength in US tech and parts of Asia.

This is the type of environment where most wealth managers throw up their hands, mutter something about “long-term investing” and do… nothing.

At TPP, we do the opposite, we lean in, adapt, and go after the opportunities that others miss.

Across all active TPP portfolios, July delivered an average return of +1.93%.

That’s after fees, after volatility, after all the market noise.

When you break it down, it gets even more interesting:

This is key: We don’t rely on one “star” trade or strategy to carry the month. Every TPP portfolio is built with multiple return drivers, so no matter what the market throws at us, something is working in your favour.

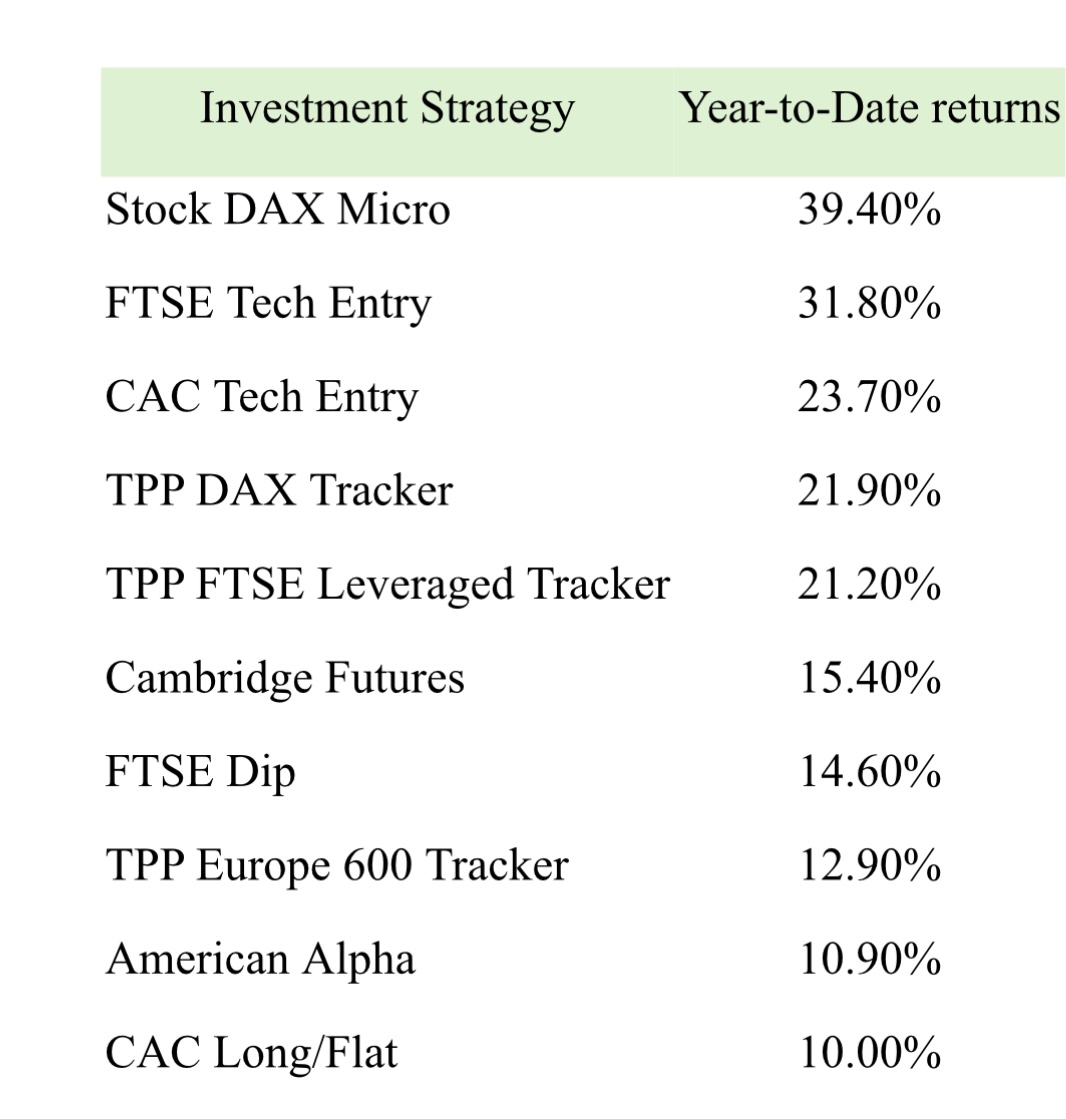

Here’s how our Top 10 looks one month into the second half of 2025:

Standout Performers – July

Here’s the difference between TPP and the fund manager who keeps sending you glossy quarterly reports with excuses:

While many global equity funds saw outflows in July, with investors pulling £1.1 billion out of equities, TPP saw continued inflows. Why? Because clients want results, not excuses.

2025 has been a year of:

We’ve built our platform to take advantage of this kind of environment. Volatile, unpredictable, but full of opportunities for those who know where to look.

Here is the bottom line:

If you’d been linked to our top strategies this year, you wouldn’t be talking about “staying patient” or “waiting for the market to recover.”

You’d be looking at your July statement thinking, “That’s another month in profit.”

You’ve just seen what our Strategy of the Month achieved, and the truth is, most investors will keep reading about results like this without ever acting. That’s why their portfolios crawl along year after year while the market moves on without them. TPP isn’t about “waiting and hoping.” It’s about putting your capital under the control of professional traders who are built to win, switching between cash and opportunity in seconds, and targeting the trades that deliver serious results.

Every month you delay is a month you’ll never get back. While you’re stuck with average, our clients are compounding returns and building the future they actually want. Don’t just watch from the sidelines, book your free call today and take the first step toward a portfolio that finally works for you.

Stop waiting for your portfolio to “recover.”

Start making it grow.

SCHEDULE YOUR CALL TODAY.

Click on the link below the main title or click here.

Disclaimer: The views expressed in this article are the author’s own and should not be considered in rendering any legal, business or financial advice.

Past performance may not be indicative of future results. Therefore, you should not assume that the future performance of any specific investment or investment strategy will be profitable or equal to the corresponding past performance.

“TPP might just be about to revolutionise investment for the retail market.”

- London Stock Exchange 2020